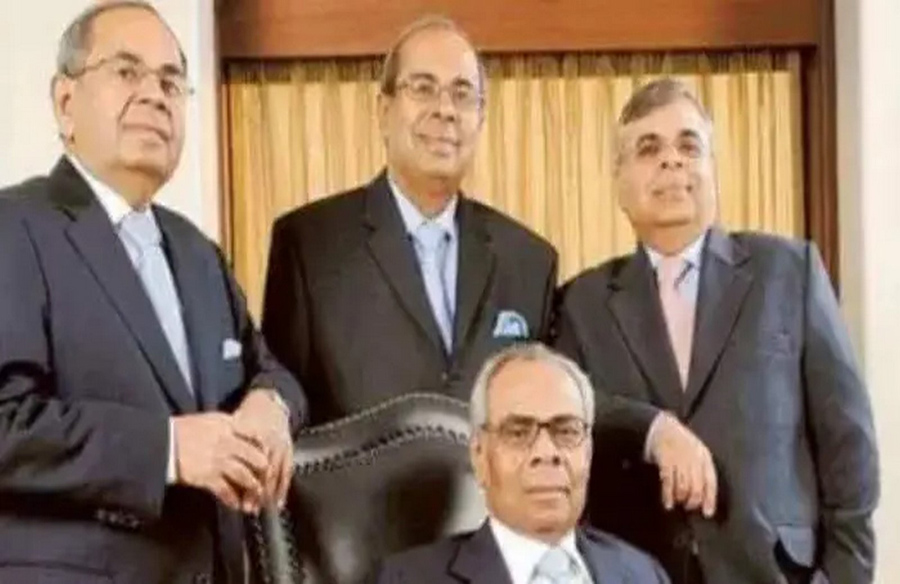

Income Tax Department’s Survey at Hinduja Group Entities

In a recent development, the Income Tax department conducted a survey operation at select entities of the Hinduja Group. The survey spanned across locations in Mumbai and other cities, forming part of an investigation into potential tax evasion activities.

Survey Operation Details

The survey operation primarily targeted office premises, adhering to the guidelines outlined in the Income Tax law for such operations. The focus remained on gathering pertinent information related to tax compliance and potential irregularities.

Response from Hinduja Group

Upon reaching out for comments, the Hinduja Group did not provide an immediate response to queries regarding the survey operation.

Link to Tax Regulations

Sources familiar with the matter mentioned that the tax department’s action is connected to the provisions of the General Anti-Avoidance Rules (GAAR), indicating a broader regulatory context for the survey operation.

Hinduja Group’s Diversification Plans

The Hinduja Group, known for its diverse business interests including ownership of entities like IndusInd Bank, Hinduja Leyland Finance, and Hinduja Bank (Switzerland), is in the process of diversification. This expansion strategy includes venturing into new technology, digital initiatives, and fintech, marking a new phase of growth for the conglomerate. Additionally, the group intends to fill strategic gaps through acquisitions, aiming to offer comprehensive solutions within the Banking, Financial Services, and Insurance (BFSI) sector.

The survey operation by the Income Tax department at Hinduja Group entities underscores the regulatory scrutiny and compliance measures prevalent in the business landscape, highlighting the importance of adherence to tax laws and regulations.